MAKING EVERY MOMENT COUNT

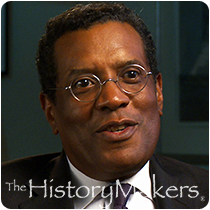

Turning on a group of seventh-graders about the excitement of high finance may be difficult for some, but when First Boston Corp. director Frederick Terrell needs help, he pulls out his heavy ammunition, comedian Eddie Murphy. Last spring, Terrell used key scenes from Murphy’s hit movie Trading Places when discussing commodities with a predominantly black inner-city class at Joan of Arc Junior High School in New York City.

Terrell, who has made a three-year commitment to teach this class twice a month, explains that there is really little difference in intellect between a stock broker and the street hustler character played by Murphy in the movie. He explains to his class: “The important thing is to get the guy who could become a street hustler the training he needs to be on Wall Street instead.” Growing up in La Puente, Calif., where very few children in his neighborhood ever go to college, Terrell is very concerned about reaching out to minority youngsters.

After receiving his bachelor’s from La Verne College, Terrell pursued a master’s degree in urban studies from Occidental College. Upon graduating and completing a post-graduate fellowship with the Coro Foundation, Terrell worked as a deputy to Los Angeles City Council President John Ferraro. But Terrell wasn’t interested in a career in government, so he went to the Yale School of Management. He spent a summer with First Boston’s public finance group in 1981 and returned after graduation the following year.

At 37, Terrell is a senior banker in his 50-member Mortgage Markets Group. On any given transaction he may have from 20 to 39 people reporting directly to him. He has primary responsibility for all transactions for federal agencies, including the Department of Veterans Affairs and the Resolution Trust Corp. (RTC), which divides about $1 trillion of business a year among a handful of prominent investment houses. The RTC account has been one of the firm’s most important business opportunities since the inception of the agency in 1989. In fact, First Boston is considered a forerunner in investment banks that have developed federal finance groups.

Last spring, Terrell led two back-to-back $1 billion securitization transactions for the RTC, the second of which, he notes, was the largest commercial securitization deal ever done. At roughly the same time, Terrell was at work on a $390 million transaction for Veterans Affairs. The deal, which featured the use of Guaranteed REMIC Pass-Through Certificates, was the first of its kind.

During his progression from associate to director, Terrell worked in municipal finance where he helped establish an innovative derivatives products group. In 1986, he transferred to investment banking. It is in his current area that Terrell says he is “able to combine all of the things I’d been working on. Asset securitization is one of the more powerful ideas to come into capital markets. I wanted to be associated with a product that had legs, something that was going to be around for a long time.”

Terrell credits his own “aggressiveness, initiative and luck, and knack of making a good impression in five minutes” for his success. He adds: “I think I’ve used my five minutes to better advantage than some.”